Resources

Case Study

HOW CROSSBAR TRAINED 53 YOUNG, DYNAMIC PROFESSIONALS JOINING A CARD FRAUD INVESTIGATION PROCESS AT OUR CLIENT LOCATION IN DALLAS,TEXAS (3 BATCHES* 5 DAYS VIRTUAL TRAINING PROGRAM DELIVERED FROM INDIA)

Situation

Our client is a global professional services firm primarily focusing on business transformation, driving digital-led innovation and

digitally-enabled intelligent operations for Global Fortune 500 companies with presence in more than 30 countries and an

unmatched level of expertise in running operations for banks, insurers, and consumer good firms.

The requirement was to remotely conduct Fraud Operations pre-process training for 50+ FTEs (a combination of freshers +

experienced resources)

The Solutions

- Crossbar jointly created a robust 5 days Pre-Process Learning Path and customised the training content covering all the

aspects of Card Fraud Operations (Fraud / Non Fraud, Card Present v/s Card Not Present, Disputes, Chargebacks, Different

Fraud Types etc.) to suit a mix batch of freshers and the experienced resources. - Every subject area was supported by real life case studies and examples, role plays, break-out rooms, puzzles, treasure

hunt, Bingo and recap sessions which were discussed in an open, interactive environment. - Entire training was conducted effectively leveraging online collaboration tools with zero disruption ensuring NO difference

from a traditional Classroom Training – all the sessions were specially designed to ensure participation from all the

candidates – with lots of exercises, tests and assessments.

Results

Case Study

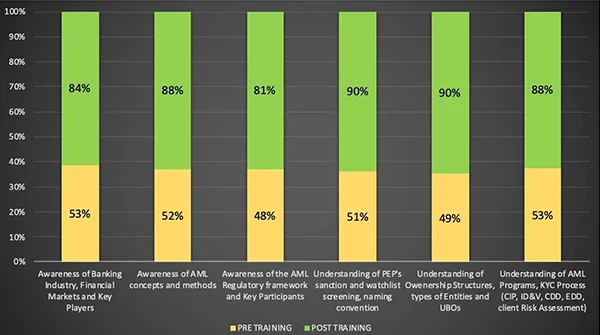

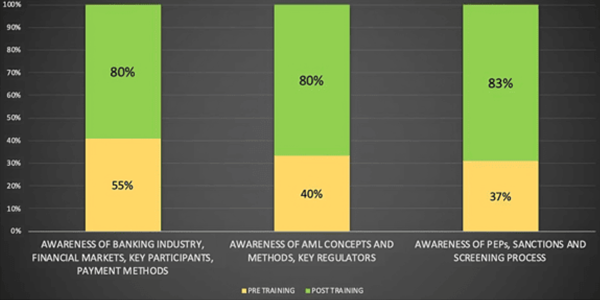

HOW CROSSBAR HELPED CLIENT FINANCIAL CRIME TEAM MEMBERS ENHANCEING THEIR OVERALL DOMAIN KNOWLEDGE FROM 44% TO 86%

Client Background

Our client is a global professional services firm primarily focusing on business transformation, driving digital-led innovation and digitally-enabled intelligent operations for Global Fortune 500 companies.

They are present in more than 30 countries with an unmatched level of expertise in running operations for banks, insurers, and consumer good firms.

Business Requirement and Crossbar Solutions

Being a leader in providing services across the Financial Crime Domain, our client is managing End to End AML KYC processes for many of the large Global Banks. As a proactive measure, they wanted to be ready for all future growth and hence were looking for engaging an external KYC AML Domain Expert to deliver deep domain

knowledge and training.

Crossbar came up with the solution, having deep Financial Crime domain experts in its panel and created a customised program for two weeks for a group of 25 resources having an average vintage of ~6 years with the client.

Salient Features

A customised program was created considering the different levels of participants with regards to AML KYC knowledge, experience and background.

The program focused on coaching and mentoring the participants by not only making them understand the concepts, but also providing them exposure to the real world situations.

Every subject area was supported by real life case studies and examples which were discussed in an open,interactive

environment.

Results

The team was able to gain a very good understanding on AML KYC concepts, process and thrilled about the expertise gained in the complex subject topics like identifying Ultimate Beneficial Ownership (UBOs), Sanctions and Watchlist

Screening, CDD/EDD, and many more.

Case Study

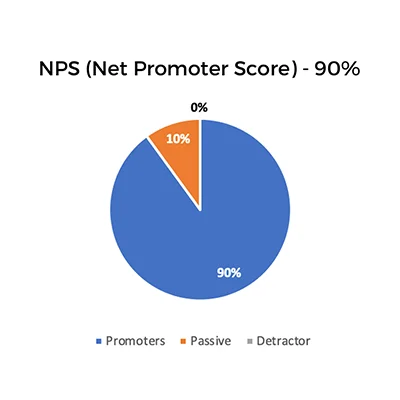

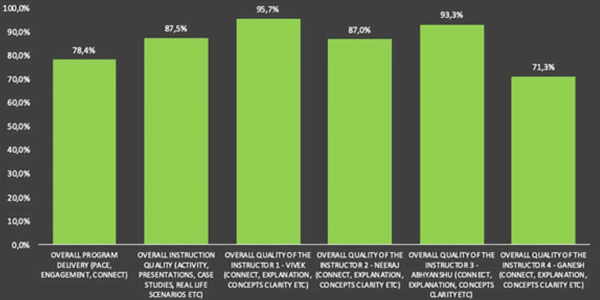

HOW CROSSBAR DELIVERED 100% VIRTUAL TRAINING FOR INSTITUTIONAL KYC WITH A NET PROMOTER SCORE (NPS) OF 80%

Context - Welcome to the New Normal

Our client is a global professional services firm primarily focusing on business transformation, driving digital-led innovation and digitally enabled intelligent operations for Global Fortune 500 companies with presence in more than 30 countries and an unmatched level of expertise in running operations for banks, insurers, and consumer good firms.

Due to COVID-19 lockdown situation, the requirement was to remotely train associates on Institutional KYC for a Social Media Giant – one of the prestigious accounts for our client.These candidates were all based out of their home towns in different parts of India.

The Solutions

- Crossbar partnered with the client and worked with the client SMEs to create a robust 10 Days Institutional KYC Learning Path. The program focused on coaching and mentoring the participants by not only making them understand the

concepts, but also providing them exposure to the real world situations. - Every subject area was supported by real life case studies and examples which were discussed in an open, interactive

environment. - Entire training was conducted effectively leveraging online collaboration tools with zero disruption ensuring NO difference from a traditional Classroom Training.

- World Class Training Content was created with Crossbar contributing with Generic Training content and the Client SMEs contributing with specific Case Studies on PEPs & Sanctions Screening and Customer Due Diligence. All the sessions were specially designed to ensure participation from all the candidates – with lots of exercises, tests and assessments.

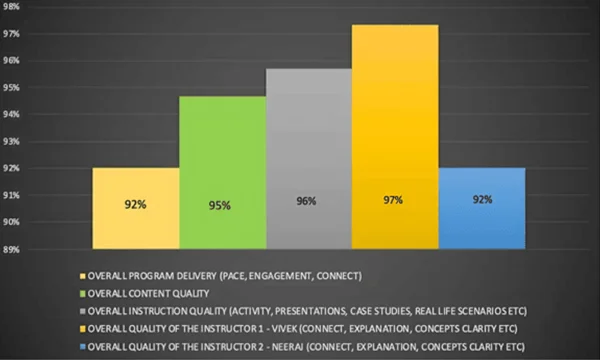

Results

The team was able to gain a very good understanding on AML, KYC concepts, Client Lifecycle Management, PEPs and Sanctions Screening, identifying Ultimate Beneficial Ownership (UBOs), Transaction Monitoring and many more.

Case Study

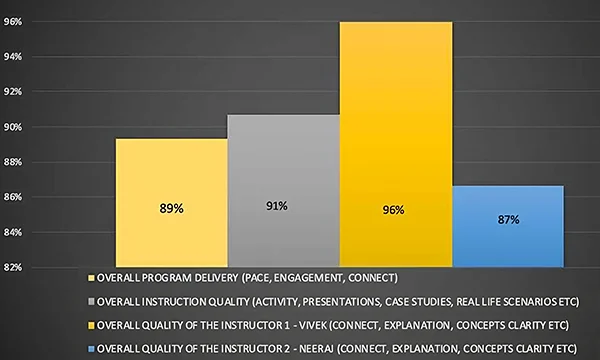

HOW CROSSBAR TRAINED A GROUP OF ANALYSTS AND HELPED INCREASING THEIR KNOWLEDGE OF PEPs & SANCTIONS SCREENING FROM 28% TO 91% (10 DAYS VIRTUAL TRAINING PROGRAM)

Situation

Our client is a global professional services firm primarily focusing on business transformation, driving digital-led innovation and digitally-enabled intelligent operations for Global Fortune 500 companies with presence in more than 30 countries and an unmatched level of expertise in running operations for banks, insurers, and consumer good firms.

The requirement was to remotely train associates on Institutional KYC for a Social Media Giant – one of the prestigious accounts for our client, Once selected, these associates will perform PEPs & Sanctions Screening for Charities & Trusts leveraging end customer’s Social Media platform.

The Solutions

- Crossbar partnered with the client and worked with the client SMEs to create a robust 10 Days Institutional KYC Learning Path. The Learning Path included comprehensive training on AML, CTF, PEPs & Sanctions Screening, Customer Due Diligence and Transaction Monitoring.

- Every subject area was supported by real life case studies and examples which were discussed in an open, interactive

environment. Entire training was conducted effectively leveraging online collaboration tools with zero disruption ensuring NO difference from a traditional Classroom Training – all the sessions were specially designed to ensure participation from all the candidates – with lots of exercises, tests and assessments.

Results

Case Study

HOW CROSSBAR TRAINED 158 FRESHERS ON AML SANCTIONS SCREENING FOR A GLOBAL SOCIAL MEDIA GIANT IN AN EXTENSIVE 5 DAYS VIRTUAL PRE-PROCESS TRAINING PROGRAM

Situation

Our client is a global professional services firm primarily focusing on business transformation, driving digital-led innovation and digitally-enabled intelligent operations for Global Fortune 500 companies with presence in more than 30 countries and annunmatched level of expertise in running operations for banks, insurers, and consumer good firms.

Our client was given a challenging task of a large ramp-up for their premier Social Media Giant – one of the prestigiousnaccounts for our client, Our client adapted a mixed strategy by hiring experienced resources externally and for the freshers, they passed-on the challenge to Crossbar to train ~160 people in 5 Days.

The Solutions

- Crossbar team reached out to the external empanelled trainers and engaged 4 trainers.

- Each trainer delivered a training batch of 35-45 participants.

- Crossbar delivered the training as per an agreed, robust 5 Days Institutional KYC Learning Path. The Learning Path included comprehensive training on AML, CTF, PEPs & largely focusing on Sanctions Screening, The participants gained real life experience by practicing 45+ real life scenario based case studies.

- Entire training was conducted effectively leveraging online collaboration tools with zero disruption ensuring NO difference from a traditional Classroom Training – all the sessions were specially designed to ensure participation from all the candidates – with lots of exercises, tests and assessments.

Results

Crossbar team successfully delivered training to all 162 candidates (including 4 experienced resources) and they were able to join thenscheduled client process trainings with an overall Net Promoter Score of 78%